Fidson Healthcare Plc’s organic expansion into new products category has delivered sustainable earnings growth for the company.

The drug maker continues to utilize the resources of its owners in generating higher profit while contemporaneously maximizing the value of shareholders.

For the year ended December 2017, Fidson’s net margins increased to 7.54 percent from 4.13 percent as at December 2016.

Net profit margin is the ratio of net profits to revenues for a company or business segment. A higher ratio means a company has been able to turn each Naira sales into higher profit.

Return on equity (ROE) increased to 14.98 percent in the period under review as against 4.79 percent the previous year.

The Nigerian drug maker has recorded a profit before tax (PBT) of N1.58 billion in full year 2017.

This figure represents a 256 percent increase from the N443 million that it recorded in the preceding year, when the industry faced huge importation cost as a result of a lengthy recession, alongside foreign exchange volatility which plagued the sector in 2016 and persisted through Q1 2017.

The stock price has rallied some 54.04 percent year to date, outperforming the market all share index at 8.53 percent, closing at 5.70 the previous week.

The company also saw an increase in revenue of 84 percent from N7.66 million in 2016 to N14.06 million in 2017, data from its full year financial statement on the stock exchange shows.

The firm’s sharp increase in revenue was a result of the increase in the firm’s production capacity due to the commencement of operations in its new WHO compliant ultra-modern manufacturing.

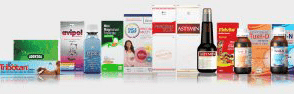

This has resulted in an expansion in sales volume of current production lines as well as introduction of new product lines consequently boosting revenue.

Fidson healthcare Plc. recently commenced operations in its brand new WHO compliant ultra-modern facility, capable of producing six distinct product lines which include; (intravenous infusions and other sterile preparations, tablets, capsules, oral liquids, creams & ointments and dry powder) while also growing volumes in existing production lines.

Another contributing factor was the recent implementation of the import adjustment tax (IAT), which has enhanced the competitive edge of local pharmaceutical producers compared with imported products.

IAT is a 20 percent tariff on four categories of finished imported pharmaceutical products which local manufacturing firms have the capacity to produce.

The firm like other top pharmaceutical players suffered a great challenge on the back of the lengthy recession that hammered the Nigerian economy in 2016, making the country go into its first full-year contraction in 25 years, and thus triggered acute dollar shortage that stifled the non-oil sector, as Africa most populous nation contracted 0.5 percent to record its worst performance since 1991.

The sector was fraught with shortage of naira liquidity as an increase in government borrowing at that time spurred banks to invest in the safety of sovereign debt rather than lending to businesses or consumers, a situation that drained cash out of the system, as the sector witnessed high operating cost since most of the raw materials are mainly imported.

However, the economy managed to limp off the recession in the second quarter of 2017 after expanding 0.55 percent, on the back of a rebound in oil prices, following an agreement reached by OPEC members in 2016 to shave some 1.2 mbpd off the market to nip a growing supply glut in the bud and relaxed hostilities in the Niger-Delta.

In addition, the non- sector recorded a positive growth for the second consecutive quarter, spurred by on-going recovery in the manufacturing sector due to improved Foreign Exchange (FX) liquidity.

Pharmaceutical firms like Fidson saw a rebound in profit and economic activities, which attracted investors’ appetite and interest to its stocks.

As reported in BusinessDay newspaper of 5th of April, 2018 By Bala Augie